This knowledge sharing was given by Milan Doshi in his best-selling book “How You Can Become a Multi-Millionaire Real Estate Investor!”, The main objective for a property investor refinance their house is to gain their downpayment that they invest earlier. That large amount of money will be beneficial for the next property downpayment and others.

From my point of view, this method is a valuable tool esspecially for small time investor (Gaji Ciput) like me. In order to sustain in property investing I need a pile of money for:

1) Downpayment (Currently LTV only covered 70% for 3rd and onwards property I wish to purchase)

2) Legal Fees (So far Rafida Razak gave the chepest rate, if interested contact me for referal)

3) Repairing works (Only purchase a house which required minor repairing works)

4) Hidden cost that I failed to anticipate ( My bad...poor forecasting)

If you are property speculator, I dont think you will adopt this method.. The reason?? Refer to my previous post -----http://firkhld.blogspot.com/2010/11/who-are-you-property-speculator-or.html. Unlike other returns like Rental Yield, Capital Appreciation, etc., it’s not possible to come up with a number or do an “apple-to-apple” comparison against other investments.

Case Study For Reference

1) Purchase Price = RM116,000 (Sub Sale = Below Market Value)

2) Market Value = RM130,000

3) Manage To get 100% loan = RM117,000 (additional RM 1k in hand)

4) MRTA '+' Legal Fees = RM4,775

5) Total Loan applied = RM 121,775

6) Interest = BLR - 1.8% = 4.5%pa (Terapung nih..bkn fixed)

7)Tenure = 40 years (Coz aku muda lagi...huhuhu)

8) Yearly Installment = RM6,569 or RM547 per month

9) Rental = RM850 per month which is enough to pay the monthly installment and service charges.

10) Hence the Cashflow = Ada la sikit utk anak bini makan....

Assumptions: Interest rate remains unchanged, no rental increase and price appreciation over 40 years

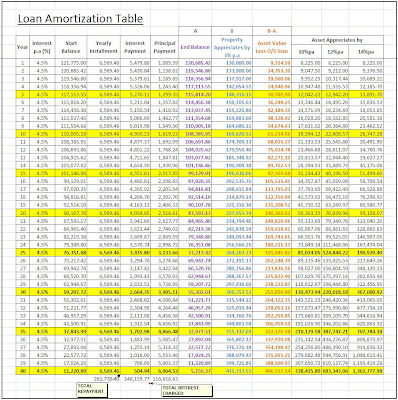

Take a look at how the loan of RM121,775 reduces over time from the Loan Amortization Table below:

There are 2 situations to derive both figures above:

1) I am as Mr. Investor:

In 20 years time, the Net Worth would increase from RM 8,225( Consider as downpayment... padahal dpt 100% loan..hehehe) to RM140,362,62. Meanwhile in 40 years time, the Net Worth is RM 411,713.51. This large amount is generated from twin benefits of property appreciation of 3% pa.

2) I am as Mr. Opportunist:

He is a person which not into properties and afraid taking loans from the bank. He chooses to diversify her RM8,225 into paper assets instead, the 20 years Net Worth grows to :

At 10% pa compound interest = RM 50,303.35

At 12% pa compound interest = RM 70,839.96

At 14% pa compound interest = RM 99,158.07

Conclusion Base on 20 Years

1) Net Worth wise, Mr Investor excellant all the way until the 20th year (Aku tak rase nk simpan rumah nih selama ini...huhuh). His Asset Value after deduct outstanding loan remaining is RM 140,362.62 . Wow!!! That is a huge amount.

2) Meanwhile Mr. Opportunist only chalk up compounded return maximum (14%) about RM 99158.07..

3) Pity to Mr. Opportunist, due to his procrastination and lack of self confident, he has missed the opportunity to become richer RM 41204.55 ( Topup sikit bole beli ZX10 mcm abg donny)