1. Over Dratf (OD)

2. OD Settlekan credit loan credit card

3. OD untuk pelaburan hartanah (rumah lelong,emas public gold, sewa, jual/beli)

Pengenalan...

Saya dah buat/guna pasal OD nie dalam 1 tahun lepas. Oleh kerana sibuk dengan urusan kerja, tak amik port sangat, tapi bila ada masa free2 tu, saya baca balik thread pasal OD nie, terus ternampak jalan (Allah tunjukkan jalan).

Mungkin ramai orang kat luar sana yang expert pasal OD nie, saya baru je nak buat. Tapi, saya dah pun buat langkah pertama. Sebab pada saya, kalau setakat belajar teori saja, memang boleh, tapi kalau kita buat secara praktikal, kita lebih faham dan akan ingat.

Apa yang saya faham pasal OD?

Saya faham OD nie merupakan satu facilities yang ada ditawarkan oleh bank untuk kita buat pengeluaran lebih dari jumlah duit yang kita ada dalam account. So, lebih kurang loan la. Tapi dari segi interest charges dia berdasarkan BLR and gunakan konsep "daily rest" (caj hari-hari). Kalau kita tak guna duit dalam OD nie, tiada sebarang caj dikenakan. So, kalau kita nak pakai duit urgent, boleh le kuarkan duit OD nie, lepas tu bayar le balik. Tapi, lately nie saya jumpa banyak blog and forum yang bincang pasal OD nie, and saya dapat info banyak yang kita boleh manipulate kemudahan OD ni untuk langsaikan hutang credit card kita, buat insvestment property dan sebagainya.

Mengenai interest OD nie, lebih rendah berbanding dengan credit card (18% p.a). So, kalau kita guna OD utk membeli barang2 yang biasa kita pakai credit card (easy payment) dan sebagainya, kita boleh jimatkan duit kita daripada membayar interest kad kredit yang tinggi kepada bank.

Saya faham benda nie pun lepas masuk banyak forum dan blog2.

Tapi, macam mana nak mula?

p/s: Seribu langkah bermula dengan langkah pertama.

1- Pakai Pelaburan ASB sebagai cagaran untuk bukak akaun OD.

Dari post2 dalam forum yang saya baca, rata-rata semua gunakan pelaburan ASB sebagai cagaran untuk bukak akaun OD ni. Ada jugak yang cagarkan rumah yang dah habih bayar. Tapi, kalau yang muda2 nie, mana ada rumah dah habih bayar. Semua masih under loan lagi.

So, apa yang saya buat adalah, tukar kan ASB (dalam bentuk buku pelaburan ke sijil). So, caranya amat mudah. Bawa buku pelaburan ASB ke PNB, (HQ atau mana2 cawangan). Kalau saya hari tu saya pergi ke cawangan Shah Alam. Tak ramai orang. Sekejap je dah siap.

So, sampai je, lengkapkan borang "Penukaran Bentuk Buku ke Sijil" mcm kat bawah nie.

Ok, lepas lengkap, pegi kaunter dan diorang akan tukarkan pelaburan kita dalam bentuk sijil ASB mcm nie.

So, lepas tu, bawak sijil nie, bersama dengan photocopy IC, slip gaji sebulan ke bank yang kita nak apply account OD. Mcm saya, saya try tanya kat Maybank (sbb senang nak manage maybank2u dan dah ada current account serta commission masuk account nie) atau RHB ( yang nie proses fee murah sikit).

Ok, minggu lepas 3/11/2008, Maybank call saya, staff bank tu cakap, akaun OD saya dah approved dan ready untuk sign letter offer. So, apa lagi, bergegas le ke Maybank Ampang Park. So, dah settle semuanya, dapat le surat macam kat bawah nie.

So, kemudiannya staff maybank tu suruh saya tunggu dalam masa 2-3 minggu untuk bank readykan amount OD tu dalam current account saya. Tapi, saya check dalam account maybank saya, dalam seminggu selepas saya signed letter offer tu, saya tengok balance dalam account dah bertambah ikut amount OD yang saya apply. So, maknanya, OD dah boleh pakai......

Penggunaan OD

1. OD untuk settlekan credit card.

Ini merupakan tujuan utama saya apply OD, untuk gantikan penggunaan credit card. Sebab siapa yang tak tau interest credit card?...18% per annum. Amik kou.....so, bayangkan kalau dengan OD BLR+0% daily rest monthly compounded. So, sekarang nie BLR 6.75%, berapa banyak jimat interest tu berbanding credit card.

Sebagai contoh, credit card saya ada hutang RM 5,000. So saya keluarkan RM 5,000 dalam account OD saya untuk settlekan hutang credit card. Bila account OD saya dah berkurang, saya kena interest OD (BLR+0% daily rest), tapi oleh kerana saya nie agent insurance (komisen masuk 2 minggu sekali, bila komisen masuk je, saya terus pindahkan ke account OD, so account OD saya pernuh balik. Tak kena interest beb. Lepas tu, kalau saya nak pakai duit untuk bayar bill atau perbelanjaan lain, saya keluarkan duit tu sikit demi sedikit. Then dalam masa 2 minggu lepas tu, masuk commission lagi, saya pindahkan dalam account OD. Jadi, interest yang saya kena bayar teramatlah kurang compare dengan credit card.

Tapi kena ingat, kita dah tak bayar credit card kan?..(sepatutnya kena bayar kalau kita tak guna duit OD)...so, duit untuk bayar credit card tu, masukkan dalam dalam ASB, tambah duit dalam ASB dan kalau dah cukup amount utk convert jadi OD, saya akan convert lagi.

So, itu je dulu sedikit info OD yang saya dah amalkan untuk settlekan credit card.

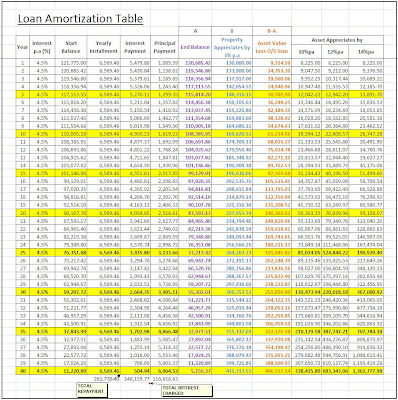

2. OD untuk pelaburan hartanah

- Untuk modal beli rumah lelong

Yang nie, ada banyak perkara kena consider, bukan terus redah. Aku sendiri menuntut dengan geng2 hartanah nie.... . Baru aku faham dan start buat.

Tips : Cari umah lelong yang below market price (and cuba nasib utk bid). Make sure study dulu lokasi dan keadaan rumah serta persekitarannya, adakah ianya sesuai untuk disewakan. Dan berapa rate sewa kat area situ. Kena buat home work sikit. Then, gunakan duit OD nie, utk bid.

Secara konsepnya...kita biasa dapat harga umah lelong below market price, kalau lebih..(rugi and kena menuntut lagi)...then, bila kita nak buat loan, loan ikut market price, of course ada margin loan kat situ. Tapi, sure korang akan terfikir, siapa yang nak bayar loan tu pulak, sebab kita buat loan baru. Sebab tu, aku cakap, perlu survey dulu, bukan main belasah je amik umah lelong, sekali tak sedar, umah kat Bukit Beruntung....masak le korang.

Jadi, bila kawasan yang tenant ramai nak sewa, duit sewa tu cover duit loan. And tenant akan bayarkan loan kita. Lepas tu pulak, ingat tak tadi , kita buat loan ikut market price...so, ada lebihan cash...apa lagi...-> ASB-OD kan lagi (top-up) sampai le ASB dah penuh. Kalau penuh, sumbat pulak kat ASW, utk buat investment rumah ke-2 dan seterusnya....

Ini yang aku buat. So, so far on track la....you all boleh cari info kat internet pasal jutawan hartanah muda2 lagi. Bermula dengan account OD-ASB ni la

Pesanan drp FIRDAUS BIN KHALID : Sebagai bumiputra marilah kita manfaat kelebihan ini dgn mencarum dalam ASB. Dah byk duit dalm ASB tu bolelah kita apply OD dan buat investment utk menambahkan pendapatan. Banyak contoh2 orang melayu yg berjaya dalam memanfaatkan kelebihan OD ni seperti PIE2020, Pokli, Hizam and Dodi.. So..tepuk dada tanyalah selera....

For futher info please click to this link

http://www.pokli.com/2010/01/ilmu-overdraft-ulanganpada-yang-tak.html